|

So will we keep the pound?

Yes, it makes sense to do so – at least in the short term. Remember the only purpose we have is to ensure that Scotland’s interests are protected. There is no requirement to be part of the UK to be able to use the pound. The Isle of Man is a perfect example of this. However we actually have three choices: • Join the Euro? No one can force us to do so since it is enshrined in EU legislation that any country wishing to join the Euro has to join the ERM (Exchange Rate Mechanism) for three years before doing so. This is specified as being entirely voluntary. It is clearly not in Scotland’s interest to join the Euro at this time due to the uncertainties in Europe. • Create our own currency? Perfectly possible and doable. There would be some expense involved which at this time we would not welcome. Additionally, given the strength of the Scottish economy, there is a danger that the new Scottish currency might become too strong and adversely affect our exports. • Remain with sterling? A safe option. The pound is already our currency and we own it as much as the rest of the UK does. Being with a slightly weaker currency will help our export industry and provide reassurance to business. Whether this is considered a short term or a long term solution only time will tell. Considerable discussion would have to take place with our business community before we took a decision to leave sterling. Remember, it’s our currency as much as the rest of UK’s! There is also confusion over the understanding on what Scotland’s relationship with the Bank of England would be. The key point is that fiscal policy would remain with the Scottish Government. That is the power to raise taxes and to decide priorities on how to spend it. The Bank of England would be responsible for monetary policy. That is the supply of money. These are clear distinctions but they are distinctions which ensure Scotland is in the driving seat over its own policies.

0 Comments

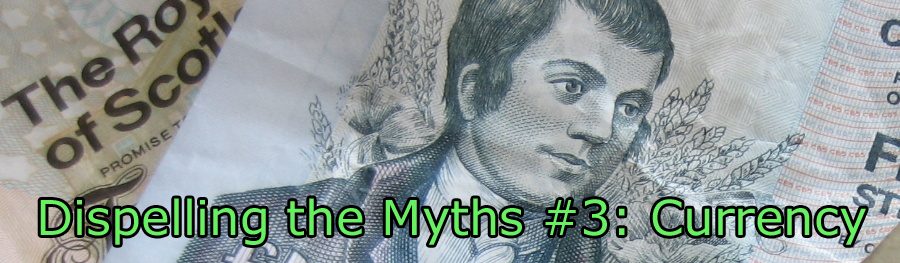

Despite the limited powers that we have available to us, the Scottish Government has managed to outdo Westminster in terms of youth unemployment. With the powers of full economic independence, we could do so much more.

So what about oil & gas?

The latest figures from the oil & gas industry indicates that the wealth remaining under the ground is now estimated at between £2.25 trillion and £4 trillion and that the oil & gas may well run until 2099! Colossal figures which will raise significant money for rejuvenating our economy. Oil & Gas account for some 19% of Scottish GDP. The equivalent figure for Norway is 29%. Yet Norway has prudently built up an oil fund worth some £400 billion. Uniquely, Scotland is told by Westminster that its vast oil wealth is actually a problem which we are not equipped to handle. No one tells Norway that its oil wealth is an embarrassment. They just get on with managing it and getting wealthier by the day. Over the next ten weeks I will be discussing the misinformation out there about Independence. I would encourage any constituents who have concerns about Independence to contact me directly.

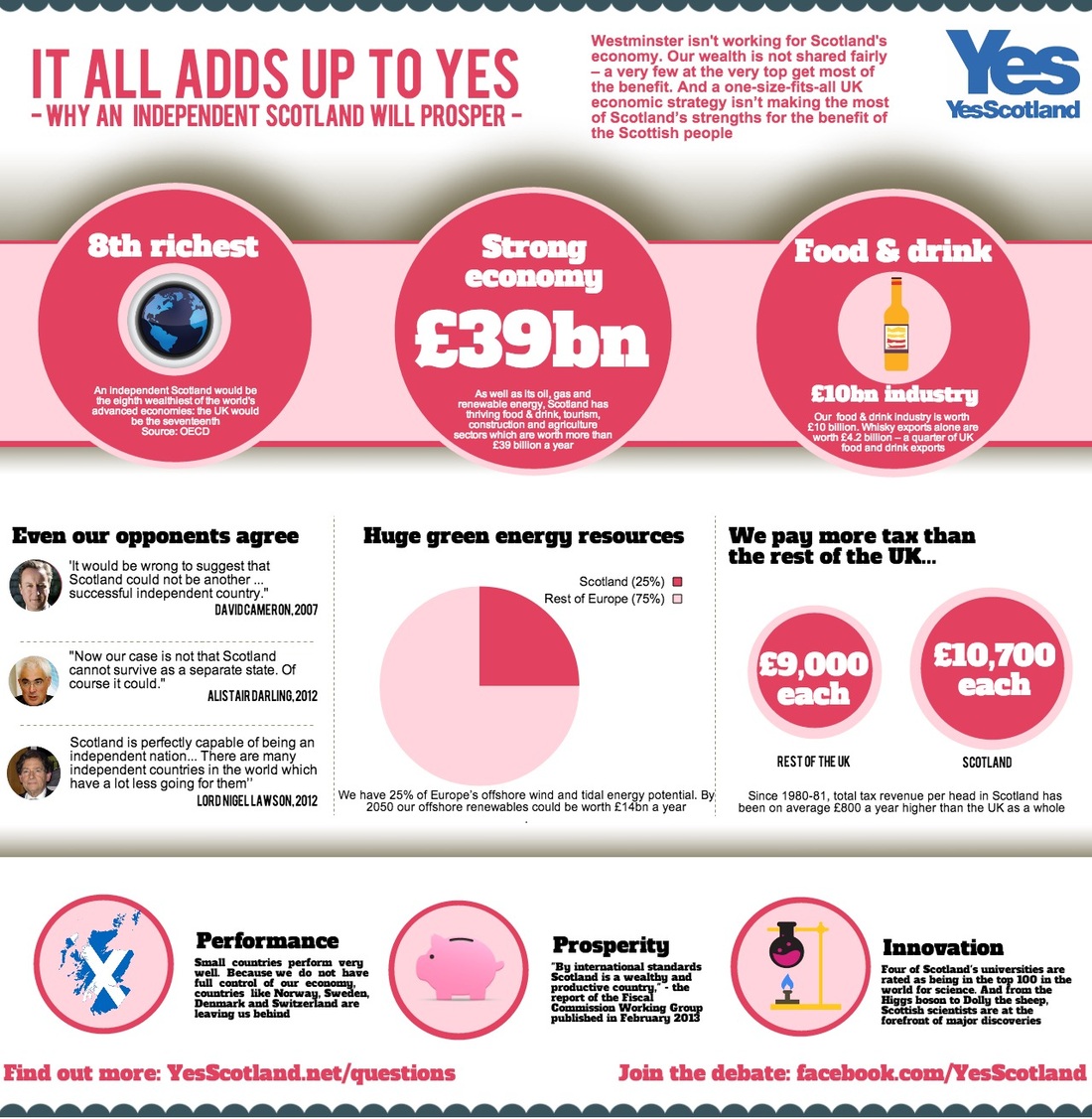

Myth No 1 – Too poor to be Independent. So you think we are too poor to be independent? Figures from the Westminster Treasury make it all too clear that Scotland is a wealthy country and that there would be an immediate benefit of £ 4.4 billion to the Scottish Treasury when we go independent. Let me just make a few more points:- • On independence Scotland will be the 6th wealthiest country in the group of rich nations (OECD), while the rest of UK will be 16th. In fact Scotland would be the 8th wealthiest nation in the world. • We have 8.4% of the population but raise 9.9% of the UK taxes. In return we receive 9.3% of the government spending. That small difference of 0.6% means a lot in terms of cash when we are talking about our national exchequer. • Hardly any European country runs without a budget deficit. Excluding oil & gas Scotland’s deficit is 5% of GDP. The equivalent figure for the whole of UK is 7.9%. Scotland’s finances are in a much better shape that the UK’s. • In fact for the past 30 years our financial position has been better than the UK’s. • First quarter 2013 economic growth in Scotland was up 0.5%. The UK as a whole was down 0.3%. Ultimately, it all adds up to YES. |

Parliamentary WorkArchives

May 2024

Links |